Data News > Buy Recommendation Issued On AMH By RBC Capital

RBC Capital analyst issues BUY recommendation for AMH on March 20, 2024 09:00AM ET. The previous analyst recommendation was Buy. AMH was trading at $35.93 at issue of the analyst recommendation. The overall analyst consensus : BUY. Current analyst recommendations are : 6 - Buy, 3 - Hold recommendations .

For more information:

Analyst Recommendations Historical Price Targets Earning Price Impact Analysis Seasonality Analysis

Buy Recommendation Issued On AMH By RBC Capital

By KlickAnalytics Data Insights | March 20, 2024 10:30AM ET

Historical Analyst Recommendations

Latest 10 recommendations| Report Date | Analyst Company | Action | Previous Grade | New Grade | Price when posted | 2024-03-20 | RBC Capital | Hold | Buy | Buy | 35.93 | 2024-03-20 | Mizuho Securities | Hold | Underperform | Underperform | 35.93 | 2023-08-28 | Raymond James | Hold | Outperform | Outperform | 35.32 | 2023-07-31 | RBC Capital | Hold | Outperform | Outperform | 37.50 | 2023-07-14 | Citigroup | Hold | Neutral | Neutral | 36.30 | 2022-12-08 | Goldman Sachs | Upgrade | Buy | 32.75 | 2022-10-06 | Barclays | Hold | Overweight | Overweight | 33.30 | 2022-09-19 | Evercore ISI | Hold | Outperform | Outperform | 35.23 | 2022-08-25 | Morgan Stanley | Hold | Equal-Weight | Equal-Weight | 36.61 | 2022-08-08 | RBC Capital | Hold | Outperform | Outperform | 37.05 |

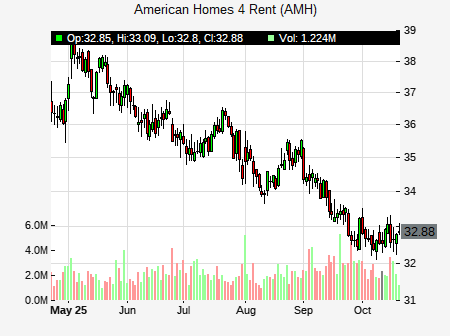

Historical Price Performance

For more information:

This article was generated by KlickAnalytics data insight content engine.

Disclaimer: the above is a summary showing certain market information. KlickAnalytics is not responsible for any data errors, omissions or other information that may be displayed incorrectly as the data is derived from various resources and more. Communications displaying market prices, data and other information available in this post are meant for purely for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any security. Please do your own research when investing. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not assure a profit, or protect against loss in a down market.