Summary

13.54 -0.04(-0.29%)05/20/2024

John Hancock Investors Trust (JHI)

John Hancock Investors Trust (JHI)

Key Facts

| 1 Day | 1 Week | 1 Month | 3 Months | 6 Months | 1 Year | 5 Years | All Time |

| -0.25 | 3.63 | 4.26 | 3.87 | 9.85 | 13.57 | 20.66 | 2,288.75 |

Last 730 data points are shown. To view all data, Upgrade to PRO plan with only $1

| Trading Data | ||

| Close | 13.73 | |

| Open | 13.77 | |

| High | 13.79 | |

| Low | 13.73 | |

| Volume | 16,370 | |

| Change | -0.03 | |

| Change % | -0.25 | |

| Avg Volume (20 Days) | 18,963 | |

| Volume/Avg Volume (20 Days) Ratio | 0.86 | |

| 52 Week Range | 11.63 - 13.85 | |

| Price vs 52 Week High | -0.86% | |

| Price vs 52 Week Low | 18.07% | |

| Range | -0.28 | |

| Gap Up/Down | -0.08 | |

Fundamentals | ||

| Market Capitalization (Mln) | 118 | |

| EBIDTA | 0 | |

| PE Ratio | 13.0190 | |

| PEG Ratio | 0.0000 | |

| WallStreet Target Price | 0.00 | |

| Book Value | 13.5120 | |

| Earnings Per Share | 1.0500 | |

| EPS Estimate Current Quarter | 0.0000 | |

| EPS Estimate Next Quarter | 0.0000 | |

| EPS Estimate Current Year | 0.0000 | |

| EPS Estimate Next Year | 0.0000 | |

| Diluted EPS (TTM) | 1.0500 | |

| Revenues | ||

| Profit Marging | 0.6815 | |

| Operating Marging (TTM) | 0.8916 | |

| Return on asset (TTM) | 0.0359 | |

| Return on equity (TTM) | 0.0780 | |

| Revenue TTM | 13,439,026 | |

| Revenue per share TTM | 1.5370 | |

| Quarterly Revenue Growth (YOY) | 0.0330 | |

| Quarterly Earnings Growth (YOY) | -0.7600 | |

| Gross Profit (TTM) | 13,602,616 | |

| Dividends | ||

| Dividend Share | 0.8750 | |

| Dividend Yield | 0.0589 | |

| Valuations | ||

| Trailing PE | 13.0190 | |

| Forward PE | 0.0000 | |

| Price Sales (TTM) | 0.0000 | |

| Price Book (MRQ) | 0.9629 | |

| Revenue Enterprise Value | 0.0000 | |

| EBITDA Enterprise Value | 0.0000 | |

| Shares | ||

| Shares Outstanding | 8,744,550 | |

| Shares Float | 0 | |

| Shares Short | 0 | |

| Shares Short (Prior Month) | 0 | |

| Shares Ratio | 0.00 | |

| Short Outstanding (%) | 0.00 | |

| Short Float (%) | 0.00 | |

| Insider (%) | 0.14 | |

| Institutions (%) | 28.64 | |

03/08 09:00 EST - seekingalpha.com

Weekly CEF Commentary | March 3, 2024 | PDX Makes The Change

Markets were flat, but upcoming events like the jobs report, PMIs, and ECB meeting are important.

Weekly CEF Commentary | March 3, 2024 | PDX Makes The Change

Markets were flat, but upcoming events like the jobs report, PMIs, and ECB meeting are important.

03/01 16:22 EST - prnewswire.com

JOHN HANCOCK CLOSED-END FUNDS DECLARE QUARTERLY DISTRIBUTIONS

BOSTON , March 1, 2024 /PRNewswire/ - The five John Hancock closed-end funds listed below declared their quarterly distributions today as follows: Declaration Date: March 1, 2024 Ex Date: March 8, 2024 Record Date: March 11, 2024 Payment Date: March 28, 2024 Ticker Fund Name Distribution Per Share Change From Previous Distribution Market Price as of 02/29/2024 Annualized Current Distribution Rate at Market HEQ Hedged Equity & Income $0.2500 - $10.22 9.78 % JHS Income Securities Trust $0.1095 -0.0182 $10.79 4.06 % JHI Investors Trust $0.2014 -0.0634 $13.14 6.13 % HTY Tax-Advantaged Global Shareholder Yield Fund $0.1600 - $5.18 12.36 % BTO Financial Opportunities Fund $0.6500 - $28.56 9.10 % John Hancock Hedged Equity & Income Fund Hedged Equity & Income Fund (the "Fund") declared its quarterly distribution pursuant to the Fund's managed distribution plan (the "HEQ Plan"). Under the HEQ Plan, the Fund makes quarterly distributions in a fixed amount of $0.2500 per share, which will be paid quarterly until further notice.

JOHN HANCOCK CLOSED-END FUNDS DECLARE QUARTERLY DISTRIBUTIONS

BOSTON , March 1, 2024 /PRNewswire/ - The five John Hancock closed-end funds listed below declared their quarterly distributions today as follows: Declaration Date: March 1, 2024 Ex Date: March 8, 2024 Record Date: March 11, 2024 Payment Date: March 28, 2024 Ticker Fund Name Distribution Per Share Change From Previous Distribution Market Price as of 02/29/2024 Annualized Current Distribution Rate at Market HEQ Hedged Equity & Income $0.2500 - $10.22 9.78 % JHS Income Securities Trust $0.1095 -0.0182 $10.79 4.06 % JHI Investors Trust $0.2014 -0.0634 $13.14 6.13 % HTY Tax-Advantaged Global Shareholder Yield Fund $0.1600 - $5.18 12.36 % BTO Financial Opportunities Fund $0.6500 - $28.56 9.10 % John Hancock Hedged Equity & Income Fund Hedged Equity & Income Fund (the "Fund") declared its quarterly distribution pursuant to the Fund's managed distribution plan (the "HEQ Plan"). Under the HEQ Plan, the Fund makes quarterly distributions in a fixed amount of $0.2500 per share, which will be paid quarterly until further notice.

02/12 17:18 EST - prnewswire.com

JOHN HANCOCK CLOSED-END FUNDS RELEASE EARNINGS DATA

BOSTON , Feb. 12, 2024 /PRNewswire/ - The John Hancock Closed-End Funds listed in the table below announced earnings1 for the three months ended January 31, 2024. The same data for the comparable three-month period ended January 31, 2023 is also available below.

JOHN HANCOCK CLOSED-END FUNDS RELEASE EARNINGS DATA

BOSTON , Feb. 12, 2024 /PRNewswire/ - The John Hancock Closed-End Funds listed in the table below announced earnings1 for the three months ended January 31, 2024. The same data for the comparable three-month period ended January 31, 2023 is also available below.

12/14 16:16 EST - prnewswire.com

JOHN HANCOCK CLOSED-END FUNDS ANNOUNCE RENEWAL OF SHARE REPURCHASE PLANS

BOSTON , Dec. 14, 2023 /PRNewswire/ - John Hancock Financial Opportunities Fund (NYSE: BTO), John Hancock Hedged Equity & Income Fund (NYSE: HEQ), John Hancock Income Securities Trust (NYSE: JHS), John Hancock Investors Trust (NYSE: JHI), John Hancock Premium Dividend Fund (NYSE: PDT), John Hancock Tax-Advantaged Dividend Income Fund (NYSE: HTD), and John Hancock Tax-Advantaged Global Shareholder Yield (NYSE: HTY) (each a "Fund" and collectively, the "Funds") announced today that the Board of Trustees has renewed the Funds' share repurchase plans. The Board of Trustees approved the renewal of the share repurchase plans as part of its ongoing evaluation of options to enhance shareholder value and potentially decrease the discount between the market price and the net asset value per share ("NAV") of the Funds' common shares.

JOHN HANCOCK CLOSED-END FUNDS ANNOUNCE RENEWAL OF SHARE REPURCHASE PLANS

BOSTON , Dec. 14, 2023 /PRNewswire/ - John Hancock Financial Opportunities Fund (NYSE: BTO), John Hancock Hedged Equity & Income Fund (NYSE: HEQ), John Hancock Income Securities Trust (NYSE: JHS), John Hancock Investors Trust (NYSE: JHI), John Hancock Premium Dividend Fund (NYSE: PDT), John Hancock Tax-Advantaged Dividend Income Fund (NYSE: HTD), and John Hancock Tax-Advantaged Global Shareholder Yield (NYSE: HTY) (each a "Fund" and collectively, the "Funds") announced today that the Board of Trustees has renewed the Funds' share repurchase plans. The Board of Trustees approved the renewal of the share repurchase plans as part of its ongoing evaluation of options to enhance shareholder value and potentially decrease the discount between the market price and the net asset value per share ("NAV") of the Funds' common shares.

09/28 16:33 EST - prnewswire.com

JOHN HANCOCK CLOSED-END FUNDS ANNOUNCE ANNUAL SHAREHOLDER MEETING AND RECORD DATES

BOSTON , Sept. 28, 2023 /PRNewswire/ - The ten John Hancock closed-end funds listed below announced today that each fund's Annual Meeting of Shareholders ("Annual Meeting") will be held on February 20, 2024, at 2:00 p.m.

JOHN HANCOCK CLOSED-END FUNDS ANNOUNCE ANNUAL SHAREHOLDER MEETING AND RECORD DATES

BOSTON , Sept. 28, 2023 /PRNewswire/ - The ten John Hancock closed-end funds listed below announced today that each fund's Annual Meeting of Shareholders ("Annual Meeting") will be held on February 20, 2024, at 2:00 p.m.

05/14 03:53 EST - seekingalpha.com

JHI: Recession Incoming, Avoid

The JHI fund focuses on a portfolio of junk bonds to generate a high yield. The JHI fund recently cut its distribution to $0.1925 / quarter or 6.1% annualized. This was predictable and expected.

JHI: Recession Incoming, Avoid

The JHI fund focuses on a portfolio of junk bonds to generate a high yield. The JHI fund recently cut its distribution to $0.1925 / quarter or 6.1% annualized. This was predictable and expected.

03/18 11:02 EST - seekingalpha.com

CEF Weekly Review: More Of The Same On The Distribution Front

We review CEF market valuation and performance through the second week of March and highlight recent market action. CEFs mostly struggled, outside of the higher-quality sectors as two bank failures spooked markets.

CEF Weekly Review: More Of The Same On The Distribution Front

We review CEF market valuation and performance through the second week of March and highlight recent market action. CEFs mostly struggled, outside of the higher-quality sectors as two bank failures spooked markets.

01/10 09:25 EST - seekingalpha.com

JHI: A Classic Example Of A Return Of Principal Fund

The JHI fund focuses on investments in junk bonds to generate a high yield. It has a current yield of 9.3%.

JHI: A Classic Example Of A Return Of Principal Fund

The JHI fund focuses on investments in junk bonds to generate a high yield. It has a current yield of 9.3%.

11/15 12:59 EST - seekingalpha.com

Weekly Closed-End Fund Roundup: Tortoise Tender Results, NCZ Resumes Distributions (November 6, 2022)

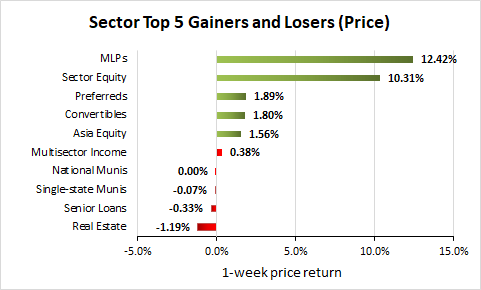

12 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. Tortoise offer tender results.

Weekly Closed-End Fund Roundup: Tortoise Tender Results, NCZ Resumes Distributions (November 6, 2022)

12 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. Tortoise offer tender results.

09/01 01:04 EST - seekingalpha.com

VTA: Do I Go Or Stay? (Spoiler Alert - I'm Outta Here!

VTA: Do I Go Or Stay? (Spoiler Alert - I'm Outta Here!)

VTA: Do I Go Or Stay? (Spoiler Alert - I'm Outta Here!

VTA: Do I Go Or Stay? (Spoiler Alert - I'm Outta Here!)

08/01 07:18 EST - seekingalpha.com

John Hancock Investors Trust: 8% Distribution Yield And Modest Credit Risk, But Easy To Overlook

John Hancock Investors Trust: 8% Distribution Yield And Modest Credit Risk, But Easy To Overlook

John Hancock Investors Trust: 8% Distribution Yield And Modest Credit Risk, But Easy To Overlook

John Hancock Investors Trust: 8% Distribution Yield And Modest Credit Risk, But Easy To Overlook

01/20 16:17 EST - prnewswire.com

John Hancock Closed-end Funds Announce Renewal of Share Repurchase Plans

BOSTON, MA, Jan. 20, 2021 /PRNewswire/ - John Hancock Financial Opportunities Fund (NYSE: BTO), John Hancock Hedged Equity & Income Fund (NYSE: HEQ), John Hancock Income Securities Trust (NYSE: JHS), John Hancock Investors Trust (NYSE: JHI), John Hancock Premium Dividend Fund (NYSE: PDT),...

John Hancock Closed-end Funds Announce Renewal of Share Repurchase Plans

BOSTON, MA, Jan. 20, 2021 /PRNewswire/ - John Hancock Financial Opportunities Fund (NYSE: BTO), John Hancock Hedged Equity & Income Fund (NYSE: HEQ), John Hancock Income Securities Trust (NYSE: JHS), John Hancock Investors Trust (NYSE: JHI), John Hancock Premium Dividend Fund (NYSE: PDT),...

12/16 07:00 EST - seekingalpha.com

JHI Is A Long-Term Corporate Bond Fund Performer But With Risks And Negatives

JHI Is A Long-Term Corporate Bond Fund Performer But With Risks And Negatives

JHI Is A Long-Term Corporate Bond Fund Performer But With Risks And Negatives

JHI Is A Long-Term Corporate Bond Fund Performer But With Risks And Negatives

08/17 20:34 EST - finance.yahoo.com

John Hancock Closed-End Funds Release Earnings Data

The eight John Hancock Closed-End Funds listed in the table below announced earnings1 for the three months ended July 31, 2020. The same data for the comparable three month period ended July 31, 2019 is also available below.

John Hancock Closed-End Funds Release Earnings Data

The eight John Hancock Closed-End Funds listed in the table below announced earnings1 for the three months ended July 31, 2020. The same data for the comparable three month period ended July 31, 2019 is also available below.

08/05 07:40 EST - seekingalpha.com

Preferreds CEF Sector Update

We give an update of the preferreds CEF sector. In aggregate the sector is trading at an expensive valuation - very close to its 7-year high premium.

Preferreds CEF Sector Update

We give an update of the preferreds CEF sector. In aggregate the sector is trading at an expensive valuation - very close to its 7-year high premium.

07/15 09:35 EST - seekingalpha.com

Performance

There are appreciation plays, mostly dominated by hi-tech, or cash flow plays, mostly dominated by closed-end funds that pay dividends monthly.

Performance

There are appreciation plays, mostly dominated by hi-tech, or cash flow plays, mostly dominated by closed-end funds that pay dividends monthly.

06/30 09:40 EST - seekingalpha.com

Weekly Closed-End Fund Roundup: June 21, 2020

4 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. MLPs lead while commodities lag. Preferreds have the highest sector

Weekly Closed-End Fund Roundup: June 21, 2020

4 out of 23 CEF sectors positive on price and 6 out of 23 sectors positive on NAV last week. MLPs lead while commodities lag. Preferreds have the highest sector