Summary

21.55 0.95(4.61%)05/17/2024

Pan American Silver Corp (PAAS)

Pan American Silver Corp (PAAS)

Key Facts

| 1 Day | 1 Week | 1 Month | 3 Months | 6 Months | 1 Year | 5 Years | All Time |

| -0.03 | 2.39 | 4.45 | 42.85 | 25.90 | 5.50 | 60.82 | 368.58 |

Last 730 data points are shown. To view all data, Upgrade to PRO plan with only $1

| Trading Data | ||

| Close | 18.89 | |

| Open | 18.80 | |

| High | 18.99 | |

| Low | 18.69 | |

| Volume | 2,222,035 | |

| Change | -0.01 | |

| Change % | -0.03 | |

| Avg Volume (20 Days) | 3,673,846 | |

| Volume/Avg Volume (20 Days) Ratio | 0.60 | |

| 52 Week Range | 12.16 - 20.59 | |

| Price vs 52 Week High | -8.28% | |

| Price vs 52 Week Low | 55.30% | |

| Range | 0.45 | |

| Gap Up/Down | -0.27 | |

Fundamentals | ||

| Market Capitalization (Mln) | 7,890 | |

| EBIDTA | 655,299,968 | |

| PE Ratio | 0.0000 | |

| PEG Ratio | 7.5900 | |

| WallStreet Target Price | 22.63 | |

| Book Value | 12.8640 | |

| Earnings Per Share | -0.4800 | |

| EPS Estimate Current Quarter | 0.1000 | |

| EPS Estimate Next Quarter | -0.0500 | |

| EPS Estimate Current Year | 0.3800 | |

| EPS Estimate Next Year | 1.0300 | |

| Diluted EPS (TTM) | -0.4800 | |

| Revenues | ||

| Profit Marging | -0.0598 | |

| Operating Marging (TTM) | 0.0431 | |

| Return on asset (TTM) | 0.0019 | |

| Return on equity (TTM) | -0.0299 | |

| Revenue TTM | 2,527,200,000 | |

| Revenue per share TTM | 6.9240 | |

| Quarterly Revenue Growth (YOY) | 0.5410 | |

| Quarterly Earnings Growth (YOY) | -0.7840 | |

| Gross Profit (TTM) | 319,275,000 | |

| Dividends | ||

| Dividend Share | 0.4000 | |

| Dividend Yield | 0.0197 | |

| Valuations | ||

| Trailing PE | 0.0000 | |

| Forward PE | 44.8430 | |

| Price Sales (TTM) | 0.0000 | |

| Price Book (MRQ) | 1.4676 | |

| Revenue Enterprise Value | 3.1935 | |

| EBITDA Enterprise Value | 15.5126 | |

| Shares | ||

| Shares Outstanding | 362,947,008 | |

| Shares Float | 362,290,066 | |

| Shares Short | 0 | |

| Shares Short (Prior Month) | 0 | |

| Shares Ratio | 0.00 | |

| Short Outstanding (%) | 0.00 | |

| Short Float (%) | 0.01 | |

| Insider (%) | 0.07 | |

| Institutions (%) | 61.93 | |

05/09 13:55 EST - zacks.com

Pan American Silver (PAAS) Q1 Earnings & Sales Beat Estimates

Pan American Silver (PAAS) witnesses a decline in Q1 earnings despite higher revenues mainly attributed to elevated production costs.

Pan American Silver (PAAS) Q1 Earnings & Sales Beat Estimates

Pan American Silver (PAAS) witnesses a decline in Q1 earnings despite higher revenues mainly attributed to elevated production costs.

05/09 13:36 EST - seekingalpha.com

Pan American Silver Corp. (PAAS) Q1 2024 Earnings Call Transcript

Pan American Silver Corp. (NYSE:PAAS ) Q1 2024 Earnings Conference Call May 9, 2024 11:00 AM ET Company Participants Siren Fisekci - VP of IR Michael Steinmann - President and CEO Steve Busby - COO Sean McAleer - SVP and MD, Guatemala Conference Call Participants Ovais Habib - Scotiabank Don DeMarco - National Bank Financial Cosmos Chiu - CIBC Operator Good morning, ladies and gentlemen, and welcome to the Pan American Silver's First Quarter 2024 Unaudited Results Conference Call and Webcast. At this time, all lines in a listen-only mode.

Pan American Silver Corp. (PAAS) Q1 2024 Earnings Call Transcript

Pan American Silver Corp. (NYSE:PAAS ) Q1 2024 Earnings Conference Call May 9, 2024 11:00 AM ET Company Participants Siren Fisekci - VP of IR Michael Steinmann - President and CEO Steve Busby - COO Sean McAleer - SVP and MD, Guatemala Conference Call Participants Ovais Habib - Scotiabank Don DeMarco - National Bank Financial Cosmos Chiu - CIBC Operator Good morning, ladies and gentlemen, and welcome to the Pan American Silver's First Quarter 2024 Unaudited Results Conference Call and Webcast. At this time, all lines in a listen-only mode.

05/08 22:01 EST - zacks.com

Pan American Silver (PAAS) Reports Q1 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Pan American Silver (PAAS) give a sense of how its business performed in the quarter ended March 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Pan American Silver (PAAS) Reports Q1 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Pan American Silver (PAAS) give a sense of how its business performed in the quarter ended March 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

05/08 19:56 EST - zacks.com

Pan American Silver (PAAS) Beats Q1 Earnings and Revenue Estimates

Pan American Silver (PAAS) came out with quarterly earnings of $0.01 per share, beating the Zacks Consensus Estimate of a loss of $0.06 per share. This compares to earnings of $0.10 per share a year ago.

Pan American Silver (PAAS) Beats Q1 Earnings and Revenue Estimates

Pan American Silver (PAAS) came out with quarterly earnings of $0.01 per share, beating the Zacks Consensus Estimate of a loss of $0.06 per share. This compares to earnings of $0.10 per share a year ago.

05/06 10:21 EST - zacks.com

Seeking Clues to Pan American Silver (PAAS) Q1 Earnings? A Peek Into Wall Street Projections for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Pan American Silver (PAAS), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended March 2024.

Seeking Clues to Pan American Silver (PAAS) Q1 Earnings? A Peek Into Wall Street Projections for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Pan American Silver (PAAS), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended March 2024.

05/02 14:43 EST - investorplace.com

Precious Profits: 3 Silver Stocks to Scoop Up on the Upswing

Silver prices are soaring in 2024, making it a prime time to consider which silver stocks to buy. Propelled by a combination of factors, including safe-haven demand due to escalating geopolitical tensions, expectations of U.S. interest rate cuts, speculative buying and a surge in industrial metals, silver price is up 15% year-to-date.

Precious Profits: 3 Silver Stocks to Scoop Up on the Upswing

Silver prices are soaring in 2024, making it a prime time to consider which silver stocks to buy. Propelled by a combination of factors, including safe-haven demand due to escalating geopolitical tensions, expectations of U.S. interest rate cuts, speculative buying and a surge in industrial metals, silver price is up 15% year-to-date.

05/01 13:12 EST - kitco.com

Pan American Silver announces the sale of La Arena for $245 million to Zijin Mining

Kitco News - Pan American Silver (NYSE: PAAS) announced today it will sell its 100% interest in La Arena S.A. , which owns the La Arena gold mine as well as the La Arena II project in Peru, to Zijin Mining Group for $245 million cash upfront and a $50 million contingent payment.

Pan American Silver announces the sale of La Arena for $245 million to Zijin Mining

Kitco News - Pan American Silver (NYSE: PAAS) announced today it will sell its 100% interest in La Arena S.A. , which owns the La Arena gold mine as well as the La Arena II project in Peru, to Zijin Mining Group for $245 million cash upfront and a $50 million contingent payment.

05/01 11:05 EST - zacks.com

Earnings Preview: Pan American Silver (PAAS) Q1 Earnings Expected to Decline

Pan American Silver (PAAS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Earnings Preview: Pan American Silver (PAAS) Q1 Earnings Expected to Decline

Pan American Silver (PAAS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

05/01 05:14 EST - businesswire.com

Pan American Silver Announces the Sale of La Arena for US$245 Million Cash Upfront and US$50 Million Contingent Payment

VANCOUVER, British Columbia--(BUSINESS WIRE)--Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) ("Pan American") announces that it has agreed to sell its 100% interest in La Arena S.A. ("La Arena"), which owns the La Arena gold mine as well as the La Arena II project in Peru, to Jinteng (Singapore) Mining Pte. Ltd., a subsidiary of Zijin Mining Group Co., Ltd. (collectively, "Zijin") for US$245 million cash upfront and a US$50 million contingent payment. "With the sale of La Arena, we continue.

Pan American Silver Announces the Sale of La Arena for US$245 Million Cash Upfront and US$50 Million Contingent Payment

VANCOUVER, British Columbia--(BUSINESS WIRE)--Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) ("Pan American") announces that it has agreed to sell its 100% interest in La Arena S.A. ("La Arena"), which owns the La Arena gold mine as well as the La Arena II project in Peru, to Jinteng (Singapore) Mining Pte. Ltd., a subsidiary of Zijin Mining Group Co., Ltd. (collectively, "Zijin") for US$245 million cash upfront and a US$50 million contingent payment. "With the sale of La Arena, we continue.

04/24 19:16 EST - zacks.com

Pan American Silver (PAAS) Flat As Market Gains: What You Should Know

In the most recent trading session, Pan American Silver (PAAS) closed at $18.62, indicating no shift from the previous trading day.

Pan American Silver (PAAS) Flat As Market Gains: What You Should Know

In the most recent trading session, Pan American Silver (PAAS) closed at $18.62, indicating no shift from the previous trading day.

04/24 02:17 EST - seekingalpha.com

Pan American Silver: Has The Potential To Improve Performance Significantly

Demand for silver has outpaced supply in recent years, driving up the price per ounce. Pan American Silver, one of the world's biggest silver producers, has seen its stock value increase by 36.31% in one month. The upcoming Q1 results may provide insight into PAAS's future performance, but the overall outlook for silver remains positive.

Pan American Silver: Has The Potential To Improve Performance Significantly

Demand for silver has outpaced supply in recent years, driving up the price per ounce. Pan American Silver, one of the world's biggest silver producers, has seen its stock value increase by 36.31% in one month. The upcoming Q1 results may provide insight into PAAS's future performance, but the overall outlook for silver remains positive.

04/16 19:20 EST - zacks.com

Pan American Silver (PAAS) Stock Slides as Market Rises: Facts to Know Before You Trade

Pan American Silver (PAAS) concluded the recent trading session at $18.80, signifying a -1.52% move from its prior day's close.

Pan American Silver (PAAS) Stock Slides as Market Rises: Facts to Know Before You Trade

Pan American Silver (PAAS) concluded the recent trading session at $18.80, signifying a -1.52% move from its prior day's close.

04/15 07:10 EST - marketbeat.com

Did You Miss the Gold Rush? Try These 2 Silver Stocks

Gold has been making all-time highs, reaching an all-time high of $2,430 per ounce on Apr. 12, 2024. The latest surge stems from tensions in the Middle East (as warnings of an imminent attack on Israel by Iran make headlines), the growing U.S. debt, and recent economic reports showing an uptick in inflation.

Did You Miss the Gold Rush? Try These 2 Silver Stocks

Gold has been making all-time highs, reaching an all-time high of $2,430 per ounce on Apr. 12, 2024. The latest surge stems from tensions in the Middle East (as warnings of an imminent attack on Israel by Iran make headlines), the growing U.S. debt, and recent economic reports showing an uptick in inflation.

04/12 06:30 EST - globenewswire.com

Patagonia Gold Reacquired the COSE Property From Pan American Silver

VANCOUVER, British Columbia, April 12, 2024 (GLOBE NEWSWIRE) -- Patagonia Gold Corp. (“Patagonia” or the “Company”) (TSXV: PGDC) is pleased to announce the closing of the transaction to reacquire the COSE property (“COSE”) from Pan American Silver Corp. (“PAAS”).

Patagonia Gold Reacquired the COSE Property From Pan American Silver

VANCOUVER, British Columbia, April 12, 2024 (GLOBE NEWSWIRE) -- Patagonia Gold Corp. (“Patagonia” or the “Company”) (TSXV: PGDC) is pleased to announce the closing of the transaction to reacquire the COSE property (“COSE”) from Pan American Silver Corp. (“PAAS”).

04/09 17:43 EST - headlinesoftoday.com

Pan American Silver to Announce First Quarter 2024 Unaudited Results and Host Annual General and Special Meeting of Shareholders on May 8

VANCOUVER, British Columbia–(BUSINESS WIRE)–Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) (“Pan American“) will announce its unaudited results for the first quarter of 2024 after market close on Wednesday, May 8, 2024. Pan American will also be holding its Annual General and Special Meeting of shareholders (the “Shareholders Meeting”) the same day at 3:00 pm … The post Pan American Silver to Announce First Quarter 2024 Unaudited Results and Host Annual General and Special Meeting of Shareho...

Pan American Silver to Announce First Quarter 2024 Unaudited Results and Host Annual General and Special Meeting of Shareholders on May 8

VANCOUVER, British Columbia–(BUSINESS WIRE)–Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) (“Pan American“) will announce its unaudited results for the first quarter of 2024 after market close on Wednesday, May 8, 2024. Pan American will also be holding its Annual General and Special Meeting of shareholders (the “Shareholders Meeting”) the same day at 3:00 pm … The post Pan American Silver to Announce First Quarter 2024 Unaudited Results and Host Annual General and Special Meeting of Shareho...

04/08 02:01 EST - headlinesoftoday.com

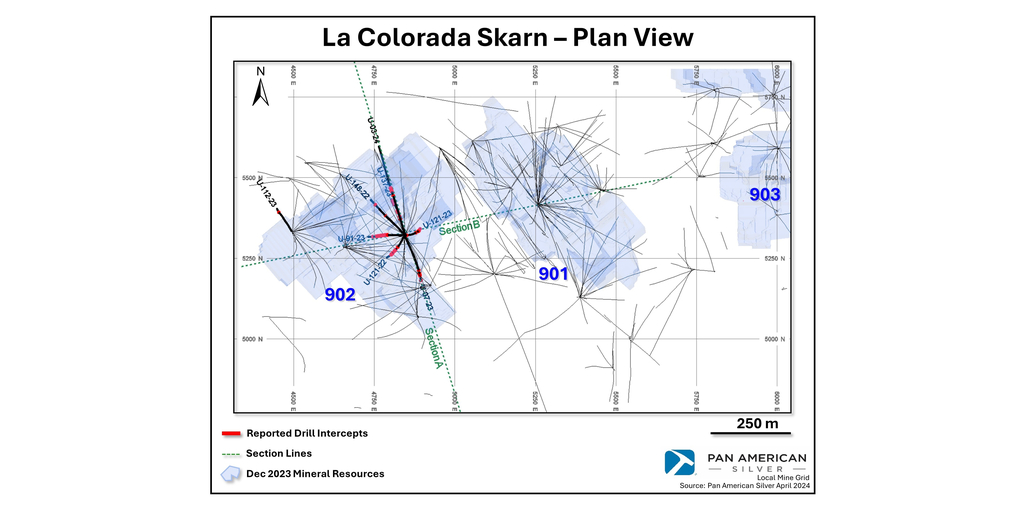

Pan American Silver reports additional high-grade drill results from the La Colorada Skarn project

VANCOUVER, British Columbia–(BUSINESS WIRE)–Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) (“Pan American” or the “Company”) releases results from the ongoing infill and geotechnical drill program at its La Colorada Skarn project in Zacatecas, Mexico (the “La Colorada Skarn”). Eight new drill holes totaling 8,101 metres returned additional wide intercepts from the 902 mineralized zone … The post Pan American Silver reports additional high-grade drill results from the La Colorada Skarn projec...

Pan American Silver reports additional high-grade drill results from the La Colorada Skarn project

VANCOUVER, British Columbia–(BUSINESS WIRE)–Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) (“Pan American” or the “Company”) releases results from the ongoing infill and geotechnical drill program at its La Colorada Skarn project in Zacatecas, Mexico (the “La Colorada Skarn”). Eight new drill holes totaling 8,101 metres returned additional wide intercepts from the 902 mineralized zone … The post Pan American Silver reports additional high-grade drill results from the La Colorada Skarn projec...

04/05 11:15 EST - fool.com

Why Silver Stocks Popped This Week

The value of silver hit a two-year high this week. Investors no longer expect big rate cuts this year as inflation remains stubbornly high.

Why Silver Stocks Popped This Week

The value of silver hit a two-year high this week. Investors no longer expect big rate cuts this year as inflation remains stubbornly high.