Data News > Outperform Recommendation Issued On EQR By Evercore ISI

Evercore ISI analyst issues OUTPERFORM recommendation for EQR on April 24, 2024 04:15PM ET. The previous analyst recommendation was Outperform. EQR was trading at $64.61 at issue of the analyst recommendation. The overall analyst consensus : BUY. Current analyst recommendations are : 6 - Buy, 1 - Hold recommendations .

For more information:

Analyst Recommendations Historical Price Targets Earning Price Impact Analysis Seasonality Analysis

Outperform Recommendation Issued On EQR By Evercore ISI

By KlickAnalytics Data Insights | April 24, 2024 06:15PM ET

Historical Analyst Recommendations

Latest 10 recommendations| Report Date | Analyst Company | Action | Previous Grade | New Grade | Price when posted | 2024-04-24 | Evercore ISI | Hold | Outperform | Outperform | 64.61 | 2024-04-22 | BMO Capital | Upgrade | Perform | Outperform | 62.54 | 2024-04-09 | Piper Sandler | Hold | Underperform | Underperform | 64.54 | 2024-04-09 | RBC Capital | Hold | Buy | Buy | 64.54 | 2024-03-18 | Raymond James | Upgrade | Market Perform | 63.03 | 2023-09-05 | Wells Fargo | Upgrade | Overweight | 64.46 | 2023-06-09 | Piper Sandler | Upgrade | Overweight | Neutral | 65.23 | 2023-06-05 | BMO Capital | Upgrade | Market Perform | Perform | 63.42 | 2023-06-05 | BMO Capital | Upgrade | Underperform | Market Perform | 63.09 | 2022-12-16 | BMO Capital | Downgrade | Underperform | 62.76 |

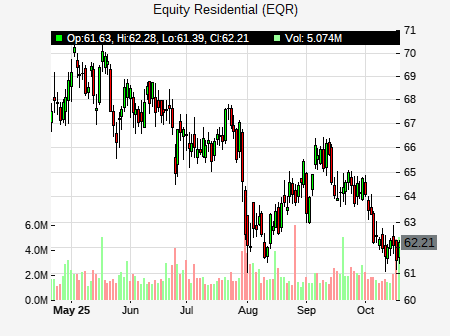

Historical Price Performance

For more information:

This article was generated by KlickAnalytics data insight content engine.

Disclaimer: the above is a summary showing certain market information. KlickAnalytics is not responsible for any data errors, omissions or other information that may be displayed incorrectly as the data is derived from various resources and more. Communications displaying market prices, data and other information available in this post are meant for purely for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any security. Please do your own research when investing. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not assure a profit, or protect against loss in a down market.